The Union Budget 2025 has introduced major changes to the new income tax regime, making it more attractive for salaried individuals. With modifications to both tax slabs and rates under the new tax regime, taxpayers with various income levels stand to benefit.

newsium.in reached out to various tax experts to understand how exactly the new changes will help taxpayers with different annual incomes, ranging from Rs 6 lakh to Rs 1 crore.

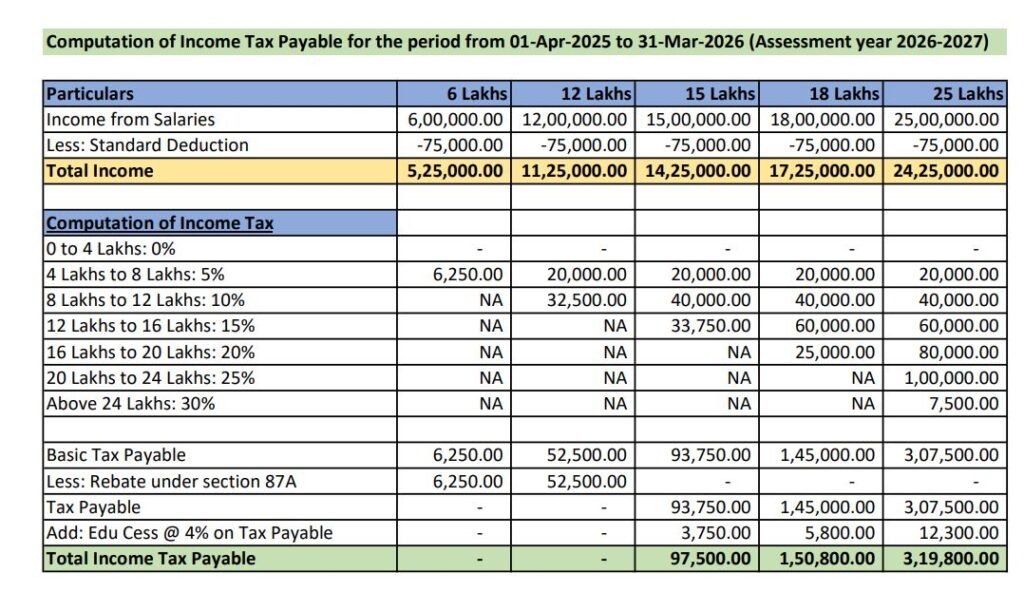

Alay Razvi, Managing Partner, Accord Juris, said salaried employees will save lakhs on tax deducted at source (TDS) deduction from their salaries. He also shared an example to show how the new tax regime changes will impact salaried taxpayers with incomes up to Rs 25 lakh:

Kunal Savani, Partner, Cyril Amarchand Mangaldas, shared the new tax rates and slabs will benefit salaried individuals earning Rs 8-25 lakh annually.

“In the proposed new tax regime, the tax liability for an individual taxpayer with a total income of up to Rs 12 lakhs will be nil,” Savani said.

He also highlighted that a salaried taxpayer earning Rs 12.75 lakh annually will not be required to pay tax due to Rs 75,000 standard deduction.

| TotalIncome | Current Tax | Proposed Tax | Reduction in Tax (before rebate) = A | Proposed Additional Rebate = B | TotalProposed BenefitA + B |

| 8 lakhs | 30,000/- | 20,000/- | 10,000/- | 20,000/- | 30,000/- |

| 12 lakhs | 80,000/- | 60,000/- | 20,000/- | 60,000/- | 80,000/- |

| 15 lakhs | 1,40,000/- | 1,05,000/- | 35,000/- | Not Allowed | 35,000/- |

| 18 lakhs | 2,30,000/- | 1,60,000/- | 70,000/- | Not Allowed | 70,000/- |

| 25 lakhs | 4,40,000/- | 3,30,000/- | 1,10,000/- | Not Allowed | 1,10,000/- |

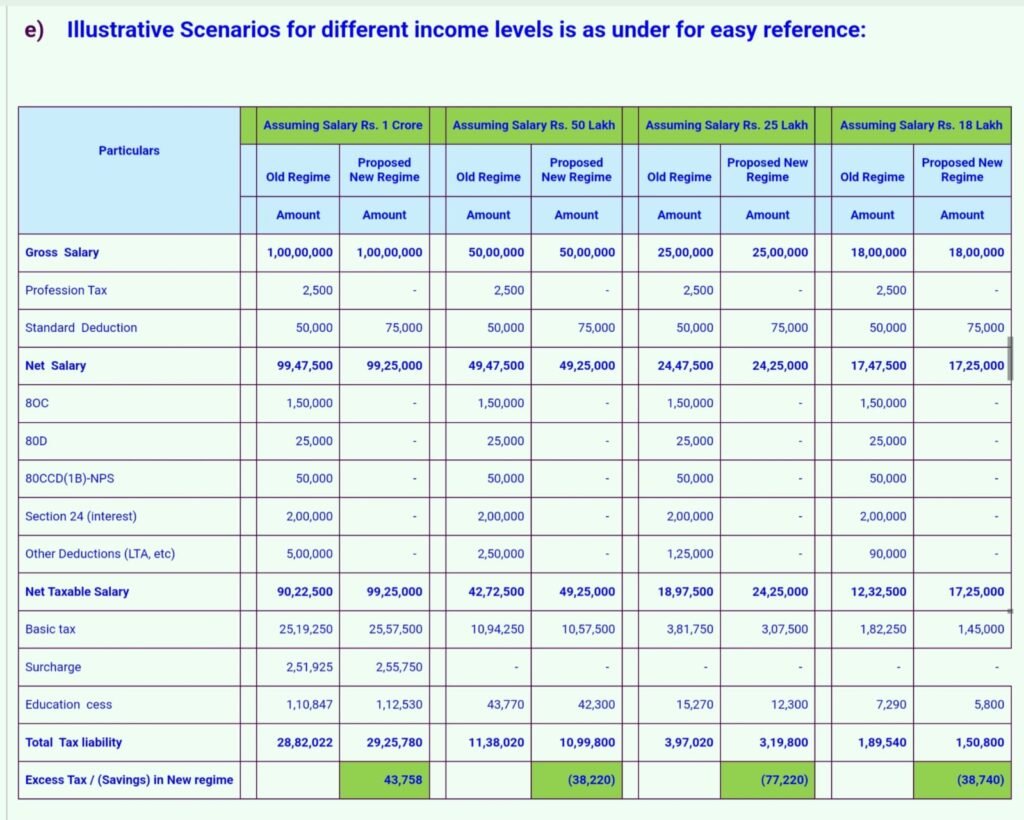

Dr Suresh Surana, a chartered accountant, also shared an illustration to show a comparison of tax calculations under the old and proposed new regime for various income categories.

Therefore, it can be concluded that the Finance Minister’s announcements in the budget have made the new tax regime more attractive, particularly for middle-class salaried employees.

While those earning up to Rs 12 lakh now pay no tax, higher-income taxpayers should evaluate their deductions and tax planning strategies before opting for the new system.

Leave a comment