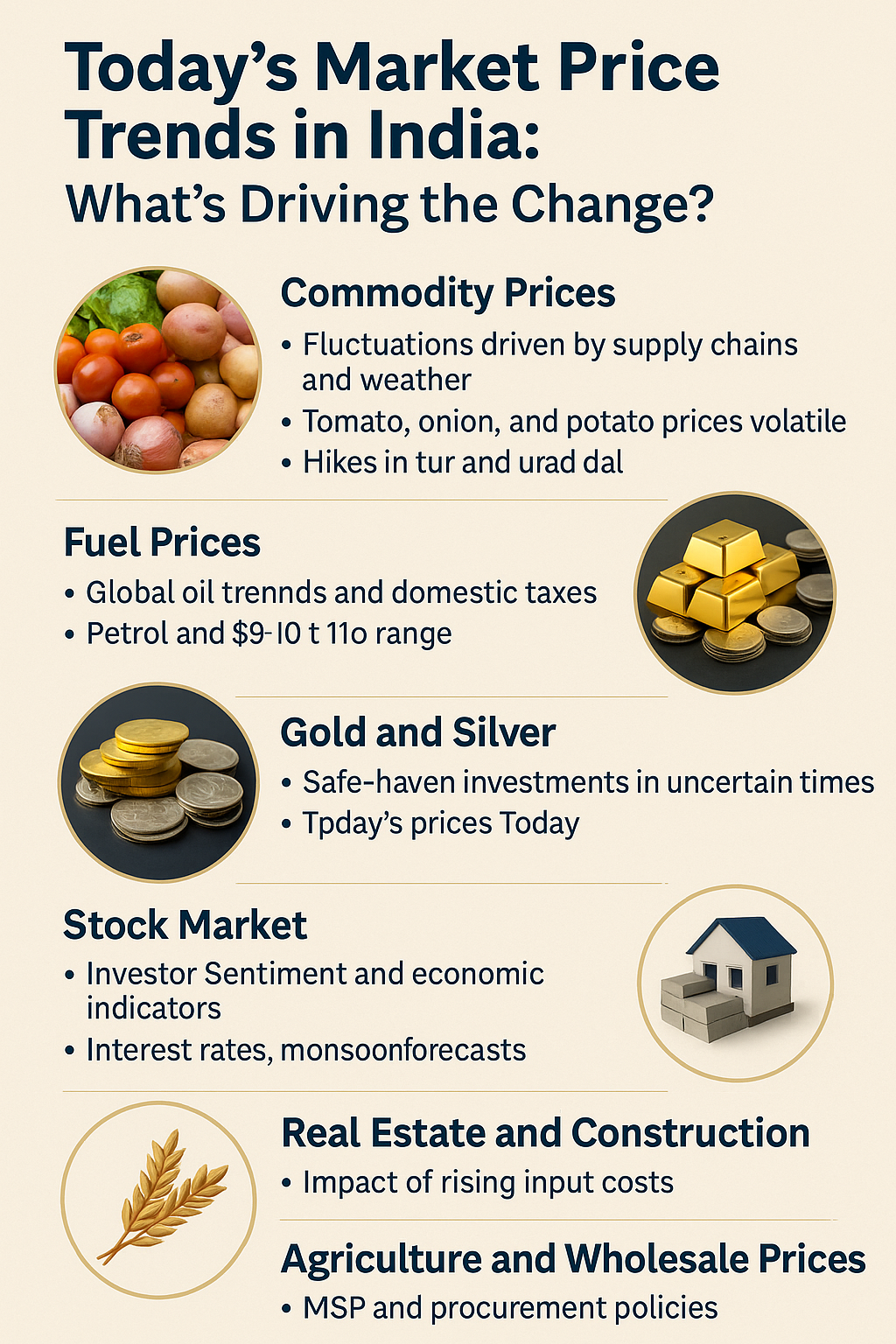

India’s market landscape is undergoing significant shifts, shaped by a dynamic interplay of domestic and global factors. From essential commodities and fuel to precious metals and agricultural produce, market prices across sectors have shown varied trends in recent weeks. Understanding these fluctuations is crucial for consumers, businesses, and policymakers alike.

Commodity Prices: Fluctuations Driven by Supply Chains and Weather

One of the most visible impacts of market volatility has been seen in the prices of essential commodities like vegetables, fruits, pulses, and grains. Unseasonal rainfall, delayed monsoons, and logistical bottlenecks have caused sporadic price spikes, especially in urban markets.

- Tomato, onion, and potato (TOP) prices have remained volatile due to seasonal disruptions.

- Wheat and rice prices are stable but under pressure due to export policies and changing demand.

- Pulses, especially tur and urad dal, have seen price hikes due to low domestic production and reliance on imports.

Fuel Prices: Global Oil Trends and Domestic Taxes

Fuel remains a major driver of inflation in India. Despite a global cooling of crude oil prices, domestic fuel rates have not significantly decreased. This is largely due to:

- High central and state government taxes.

- A cautious approach by oil marketing companies.

- International factors like geopolitical tensions and production cuts by OPEC+ nations.

As of today, petrol prices in major metros range between ₹96 to ₹110 per litre, while diesel prices range between ₹89 to ₹100 per litre, depending on the city.

Gold and Silver: Safe-Haven Investments in Uncertain Times

Precious metal prices have remained elevated in India. Investors are increasingly turning to gold and silver as a hedge against inflation and market uncertainty.

- 24K gold today is priced around ₹9,850 per gram.

- Silver hovers near ₹118 per gram.

Factors driving this include:

- Geopolitical tensions.

- Global economic uncertainty.

- Strong demand during wedding and festive seasons in India.

Stock Market: Investor Sentiment and Economic Indicators

The BSE Sensex and NSE Nifty have shown mixed trends. While foreign institutional investors (FIIs) have shown renewed interest, concerns remain around:

- Interest rate policies by RBI and US Fed.

- Monsoon forecasts.

- Political developments ahead of upcoming state elections.

Sectoral indices such as banking, IT, and pharma are showing resilience, while FMCG and auto sectors remain cautious due to demand fluctuations.

Real Estate and Construction: Impact of Rising Input Costs

Material prices like cement, steel, and sand have surged again, impacting the construction sector and property rates.

- Increased demand from infrastructure projects.

- High transportation and fuel costs.

- Labour shortages in some regions post-COVID.

These factors are pushing up both construction costs and real estate prices, especially in Tier-1 and Tier-2 cities.

Agriculture and Wholesale Prices: MSP and Procurement Policies

The government’s Minimum Support Price (MSP) regime, combined with procurement and warehousing policies, continues to influence the market prices of major crops like paddy, wheat, and cotton.

Recent decisions on MSP hikes are expected to:

- Benefit farmers.

- Raise procurement costs.

- Ultimately impact retail inflation.

Conclusion

Today’s market price trends in India are shaped by a complex set of factors—ranging from global commodity prices and monsoon patterns to government policy and consumer behavior. While some price increases are seasonal and temporary, others reflect deeper structural issues in supply chains, taxation, and international trade.

Staying informed about these trends is essential not just for economic analysts and investors, but for every consumer and business in India trying to navigate a fast-evolving market.