Prime Minister Narendra Modi recently shared an article that highlights how the latest Goods and Services Tax (GST) reforms are transforming the food processing sector in India. The article emphasizes the role of GST in reducing inefficiencies, cutting down compliance burdens, and creating a unified national market that encourages both domestic and global investments.

The Prime Minister’s move to share this article is not just symbolic; it underlines the government’s continued push toward strengthening ease of doing business across sectors. The food processing industry, often called the “sunrise sector” of India, is among the biggest beneficiaries of GST reforms. With agriculture at the heart of the Indian economy, reforms in food processing are expected to boost farmers’ incomes, generate employment, and enhance exports.

Why GST Reforms Matter

Before GST was introduced in 2017, India’s indirect tax system was fragmented and complicated. Different states had their own VAT (Value Added Tax) rates, entry taxes, octroi, and multiple layers of excise and service tax. For the food processing industry, this meant:

- Higher logistics costs due to multiple checkpoints.

- Cascading taxes (tax on tax), increasing the final price.

- Unequal competition between states because of varying tax structures.

- Increased compliance and paperwork, especially for businesses operating across state borders.

The introduction of GST brought all these under one umbrella, creating a One Nation, One Tax framework. Over the years, several refinements and reforms in GST have further eased the burden on businesses.

Key GST Reforms Benefiting Food Processing

1. Simplified Tax Structure

Earlier, processed food items faced different rates depending on the state and product. GST has created a uniform structure. Basic food items are kept at 0–5% GST, while processed and packaged foods fall mostly under the 5% or 12% bracket. This clarity helps businesses plan better and encourages formalization.

2. Elimination of Cascading Taxes

The biggest benefit of GST is the availability of Input Tax Credit (ITC). Food processors can now claim credit for the taxes paid on raw materials, packaging, and transport. This reduces overall costs and makes products more competitive in domestic and international markets.

3. Easier Inter-State Trade

Earlier, transporting goods from one state to another required multiple permits and payments. The GST e-way bill system and removal of border check posts have cut logistics costs drastically. For perishable goods like fruits, vegetables, dairy, and meat products, this has been a game changer.

4. Encouraging Formalization of the Sector

The food processing sector in India has traditionally been dominated by small and unorganized players. GST compliance, while initially seen as a challenge, has gradually encouraged formalization. Small businesses registering under GST can avail input tax credit and build credibility, which helps them access bank loans and government schemes.

5. Boost to Cold Chain and Logistics

GST has reduced tax on refrigerated transport and storage. This encourages investment in modern cold chain infrastructure, essential for India’s large agricultural base. Better logistics also mean reduced wastage of perishable goods, benefiting both farmers and consumers.

6. Lower Tax Burden on Processed Foods

Over the years, GST rates on several food items have been rationalized. For example, frozen vegetables, fruit pulps, dairy products, and ready-to-cook meals have seen a more reasonable tax structure. This has helped businesses scale up operations and increase product diversity.

Impact on Farmers and Rural Economy

The reforms in GST indirectly benefit farmers as well. Here’s how:

- Better Market Access: Farmers can now sell produce to processors located in different states without worrying about local taxes reducing their margins.

- Less Wastage: Improved logistics and reduced transit delays mean less spoilage of perishable crops.

- Higher Demand: With food processors finding it easier to operate and expand, demand for agricultural produce increases, boosting farmers’ incomes.

The government has repeatedly emphasized its vision of “Doubling Farmers’ Income”, and GST reforms in food processing are playing a supporting role in achieving this.

Boosting Employment Opportunities

Food processing is labor-intensive, creating jobs in manufacturing units, packaging, logistics, cold storage, and retail. By reducing tax complications and operational costs, GST reforms have made it easier for companies to expand capacity and hire more workers.

Industry estimates suggest that the food processing sector could generate 9–10 million new jobs by 2030, especially in rural and semi-urban regions. This aligns with the government’s agenda of creating employment beyond traditional agriculture.

Strengthening Exports

India is already among the top exporters of processed foods such as rice, spices, marine products, and ready-to-eat meals. GST reforms provide exporters with seamless credit on taxes paid, making Indian products more competitive globally.

Simplified processes and the move towards digitization of GST filings have reduced compliance hurdles for exporters. As a result, Indian food exports are expected to grow significantly in the coming years, helping India position itself as a global food processing hub.

Ease of Doing Business Rankings

Ease of doing business is a critical factor for attracting investments. Since the rollout of GST and other business-friendly reforms, India has climbed steadily in global rankings. The food processing sector, which used to struggle with multiple tax regimes and bureaucratic delays, now enjoys a much smoother regulatory environment.

This has drawn interest from both domestic companies and multinational corporations (MNCs). Global giants in dairy, beverages, and packaged foods are setting up or expanding operations in India, creating a multiplier effect on the economy.

Government Initiatives Alongside GST

The Prime Minister’s article also highlights how GST reforms complement other initiatives:

- Pradhan Mantri Kisan SAMPADA Yojana (PMKSY): Offers grants and incentives for setting up processing units and cold chain projects.

- PLI Scheme for Food Processing: Encourages large-scale investments in value-added products.

- Atmanirbhar Bharat & Make in India: Promotes domestic production and reduces dependency on imports.

Together with GST, these initiatives form a comprehensive ecosystem that supports growth.

Challenges Ahead

While GST reforms have had a positive impact, challenges remain:

- High Compliance for Small Businesses: Many small food processors still find GST filing complicated. Simplification and hand-holding are needed.

- Rate Rationalization: Some processed foods are still taxed at higher slabs (18%), which industry bodies argue should be reduced.

- Awareness Issues: Farmers and micro-enterprises are often unaware of GST benefits like input tax credit. More outreach is needed.

Addressing these challenges will further strengthen the sector’s growth trajectory.

Expert Opinions

Industry experts and trade associations have largely welcomed the GST reforms. The Federation of Indian Chambers of Commerce & Industry (FICCI) noted that GST has created “a level playing field” and improved competitiveness. Similarly, the Confederation of Indian Industry (CII) emphasized that GST has been instrumental in encouraging investments in cold chain infrastructure.

Global consultants also see India’s food processing sector as a trillion-dollar opportunity in the making, with GST being a foundational reform.

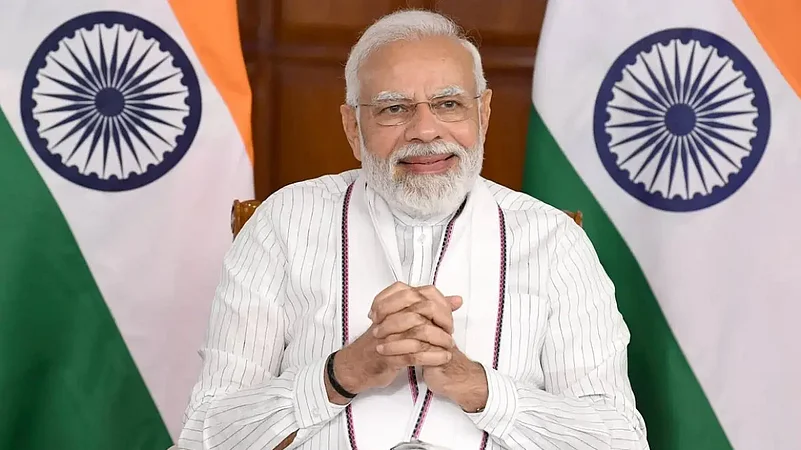

PM Modi’s Vision

By sharing the article, Prime Minister Modi reinforced his government’s vision of building a modern, efficient, and competitive food processing ecosystem. His emphasis on GST reforms reflects the belief that a simplified and transparent tax system is essential for India’s economic transformation.

The PM has often spoken about making India a global food factory, serving both domestic needs and international markets. The latest GST reforms, combined with supportive policies, are vital steps toward realizing this dream.